Mortgage rates are still a hot topic – and for good reason. After the most recent jobs report came out weaker than expected, the bond market reacted almost instantly. And, as a result, in early August mortgage rates dropped to their lowest point so far this year (6.55%).

While that may not sound like a big deal, pretty much every buyer has been waiting for rates to fall. And even a seemingly small drop like this reignites the hope we’re finally going to see rates trending down. But what’s realistic to expect?

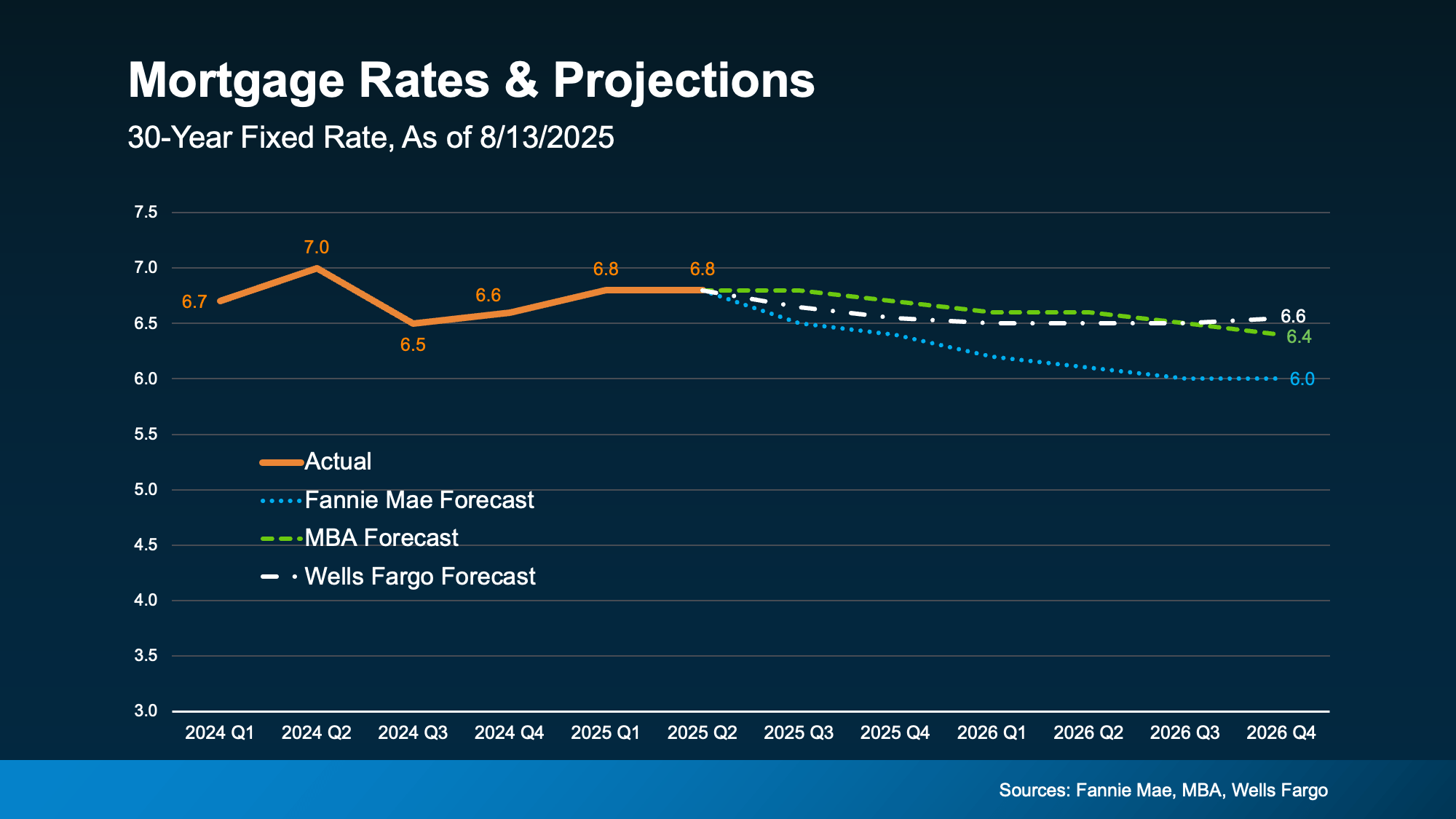

According to the latest forecasts, rates aren’t expected to fall dramatically anytime soon. Most experts project they’ll stay somewhere in the mid-to-low 6% range through 2026 (see graph below):

In other words, no big changes are expected. But small shifts, like the one we just saw, are still likely.

In other words, no big changes are expected. But small shifts, like the one we just saw, are still likely.

Each time there’s changing economic news, there’s a chance mortgage rates will react. And with so many reports coming out this week, we’ll get a better feeling of where the economy and inflation are headed – and how rates will respond.

What Rate Would Get Buyers Moving Again?

The magic number most buyers seem to be watching for is 6%. And it’s not just a psychological benchmark; it has real impact. A recent report from the National Association of Realtors (NAR) says if rates reach 6%:

- 5.5 million more households could afford the median-priced home

- And roughly 550,000 people would buy a home within 12 to 18 months

That’s a lot of pent-up demand just waiting for the green light. And if you look back at the graph above, you’ll see Fannie Mae thinks we’ll hit that threshold next year. That raises an important question: Does it really make sense to wait for lower rates?

Because here’s the tradeoff. If you’re waiting for 6%, you need to realize a lot of other people are too. And when rates do continue to inch down and more buyers jump into the market all at once, you could face more competition, fewer choices, and higher home prices. NAR explains it like this:

“Home buyers wishing for lower mortgage interest rates may eventually get their wish, but for now, they’ll have to decide whether it’s better to wait or jump into the market.”

Consider the unique window that exists right now:

- Inventory is up = more choices

- Price growth has slowed down = more realistic pricing

- You may have more room to negotiate = you could get a better deal

These are all opportunities that will go away if rates fall and demand surges. That’s why NAR says:

“Buyers who are holding out for lower mortgage rates may be missing a key opening in the market.”

Bottom Line

Rates aren’t expected to hit 6% this year. But when they do, you’ll have to deal with more competition as other buyers jump back in. If you want less pressure and more negotiating power, that opportunity is already here – and it might not last for long. It all depends on what happens in the economy next.

Talk to a local agent about what’s happening in your area and whether it makes sense to make your move now, before everyone else does.