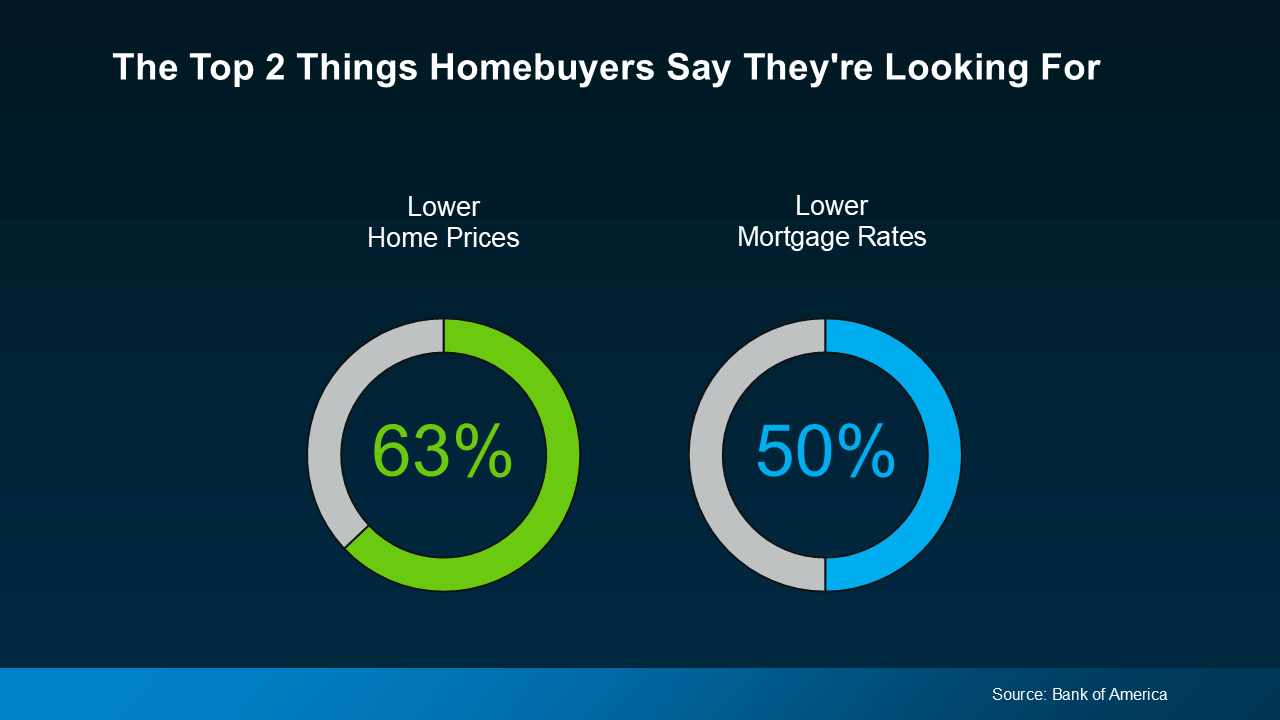

A recent survey from Bank of America asked would-be homebuyers what would help them feel better about making a move, and it’s no surprise the answers have a clear theme. They want affordability to improve, specifically prices and rates (see below):

Here’s the good news. While the broader economy may still feel uncertain, there are signs the housing market is showing some changes in both of those areas. Let’s break it down so you know what you’re working with.

Here’s the good news. While the broader economy may still feel uncertain, there are signs the housing market is showing some changes in both of those areas. Let’s break it down so you know what you’re working with.

Prices Are Moderating

Over the past few years, home prices climbed fast, sometimes so fast it left many buyers feeling shut out. But today, that pace has slowed down. For comparison, from 2020 to 2021, prices rose by 20% in a 12-month period. Now? Nationally, experts are projecting single-digit increases this year – a much more normal pace.

That’s a sharp contrast to the rapid growth we saw just a few short years ago. Just remember, price trends are going to vary by area. In some markets, prices will continue to rise while others will experience slight declines.

Prices aren’t crashing, but they are moderating. For buyers, the slowdown makes buying a home a bit less intimidating. It’s easier to plan your budget when home values are moving at a much slower pace.

Mortgage Rates Are Easing

At the same time, rates have come down from their recent highs. And that’s taken some pressure off would-be homebuyers. As Lisa Sturtevant, Chief Economist at Bright MLS, says:

“Slower price growth coupled with a slight drop in mortgage rates will improve affordability and create a window for some buyers to get into the market.”

Even a small drop in mortgage rates can mean a big difference in what you pay each month in your future mortgage payment. Just remember, while rates have come down a bit lately, they’re going to experience some volatility. So don’t get too caught up in the ups and downs.

The overall trend in the year ahead is that rates are expected to stay in the low to mid-6s – which is a lot better than where they were just a few short months ago. They may even drop further, depending on where the economy goes from here.

Why This Matters

Confidence in the economy may be low, but the housing market is showing signs of adjustment. Prices are moderating, and rates have come down from their highs.

For you, that may not solve affordability challenges altogether, but it does mean conditions look a little different than they did earlier this year. And those shifts could help you re-engage as we move into next year.

Bottom Line

Both of the top concerns for buyers are seeing some movement. Prices are moderating. Rates are easing. And both trends could stick around going into 2026.

If you’re considering a move, connect with a local real estate agent to walk you through what’s happening in your area – and what it means for your plans.